Introduction

Later last year (2020) I bought a few bitcoin, that went up in value. A few months later, in January 2021, in a moment’s panic, as the price dropped, I sold them.

I now found myself in a neutral position again to see if it was worth reinvesting what I’d made (and by this time I had done a lot more research). To cut a long story short, yes, but no.

Yes, because for the time being, I expect Bitcoin to continue increasing in value.

No, because Bitcoin has mutated into a monstrous, unethical ponzi scheme that utterly fails to live up to what was described in the original whitepaper. Instead of peer to peer cash-like payments, it is now being used for speculation, as “digital gold”, with holders of Bitcoin egging others on to buy Bitcoin at increasingly ridicolous prices, with little to no regard for those who will be left holding the bag when the music stops.

Tim Bray

The first article online that made me pause for thought was written by Tim Bray, who’s been experimenting with Bitcoin for years and is clearly familiar with the technology.

Here’s the key paragraph in his recent post:

What I see now: Run screaming from Bitcoin · It is completely unambiguously obvious to me that Bitcoin, a brilliant achievement technically, is functioning as a Ponzi scheme, siphoning money from the pockets of rubes and into those of exchange insiders and China-based miners. I’m less alone in this position than I was in some of those others, I think a high proportion of tech insiders know perfectly well that this is a looming financial disaster.

Amy Castor

Tim then references Amy Castor who’s been researching various cases of what seems like fraudulent activity at the very centre of Bitcoin, such as USDT: a token used on exchanges to buy Bitcoin, but which hasn’t properly been audited. For all we know these tokens are being produced out of thin air and then being used to buy Bitcoin, encouraging others to then spend their hard-earned real money in fear of missing out of getting rich.

Crypto Anonymous

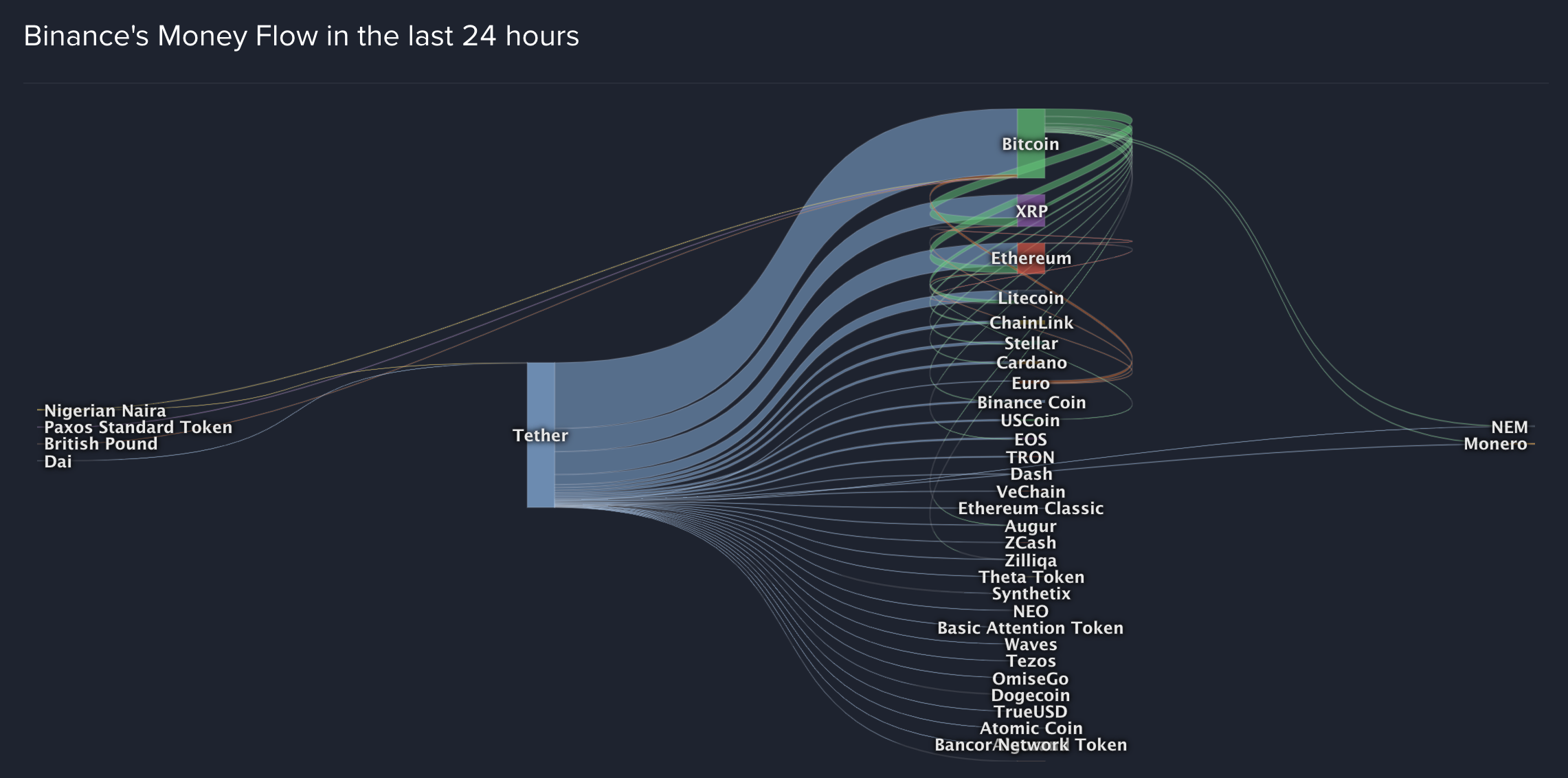

Then I found an article by someone clearly wanting to remain anonymous explaining the rate at which Tether (USDT) is being used to buy Bitcoin and other cryptocurrencies:

There’s a shocking level of reliance on these USD-T tokens, and a strong correlation between their issuance and the price of Bitcoin going up. The issuers have a questionable history, and we don’t even know if their books are clean yet.

David Gerard

Tether (USDT) is the cryptocurrency trading economy’s favourite substitute US dollar. Most Bitcoin trading is against USDT — not against actual money. There’s about 27 billion tethers in circulation.

Patrick Mackenzie

A friend of mine, who works in finance, asked me to explain what Tether was.

Short version: Tether is the internal accounting system for the largest fraud since Madoff.

Be sure to read the long version too. Patrick now works at Stripe, and although he probably can’t speak for them, he likely sees the writing on the wall, with his employer planning accordingly. If Stripe too saw Bitcoin as the next big thing, they’d be preparing APIs for it. Instead Stripe publicly dropped support for Bitcoin in 2018.

Decentralisation

That bitcoin and other cryptocurrencies are decentralised is just a huge dangerous lie.

- The source code is controlled by a central committee of developers who control the direction of the project.

- They’re human and far from perfect, having previously cancelled Gavin Andresen, one of the original co-creators of Bitcoin for naming Craig Wright as the original creator of Bitcoin (“Satoshi Nakamoto”).

- If only a centralised committee of unaccountable developers can change the protocol that has critical mass at any time, it’s not decentralised. In fact it’s more dangerous than money being in the control of accountable government officials.

- Bitcoin is in some sense being sold as decentralised (all users are “equal”) in the way communism is/was sold as decentralised (all people are “equal”). Yet we know from history that such abdication of agency never ends well. When everyone pretends no one is in power and everyone is equal, it only sets the stage for some really dangerous characters to take control.

- This is no defense of the current financial system – it has flaws, but is also well regulated by the government with appointed staff (by those elected by people) who are accountable for the smooth and fair running of the system.

- With “decentralisation” there is no notion of accountability – how can there be, when every node and user is equal? Who do you go to or appeal to if something goes badly wrong?

The “decentralisation” Bitcoin promises, like communism, is based on a lie that’s impossible – a logical fallacy. Abdication of agency never works, and a consensus based algorithm is no substitute for it.

Even if you on some level buy the decentralised argument, consider this:

Bitcoin vs Fiat

Bitcoin is commonly advertised as a hedge against fiat. Yet, put simply:

Usefulness

The other argument often made is that Bitcoin has no actual use despite all the money flowing into it and other cryptocurrencies. Patrick explains this well:

I don’t hold any position in cryptocurrencies. I continue to believe that they’ve produced substantially no value in the world. I’m not philosophically opposed to shorting them to zero, but the mechanics of doing that are non-trivial.

…

My intense skepticism of cryptocurrencies is probably the issue on which I am most in disagreement with many close friends, professional acquaintances, and some of the smartest people I know. That is part of the reason why the hobby of peeling back onion layers here is so engrossing: people really, passionately believe that there is something here. I’m intellectually curious. The thing people have told me exists should smash my interest buttons: programmable money! How could I not look!?

I have looked, quite a bit. I have not found a good use case yet, or the revolutionary technology advances that my friends tell me exist, but I have found some frauds.

Institutions

Mark Cuban quips:

By whales, one usually means very wealthy individuals or more often institutions who can buy $millions or even $billions worth of bitcoin, like Square did. Yet:

As of yet, no answers. Meanwhile I’ll assume Bitcoin is not only unethical but impracticle too. Can you imagine Apple or Tesla having an asset that’s expected to go up and down in orders of magnitude through the years on their balance sheet?

Yet according to Bitcoin proponent Michael Saylor, you’re expected to believe this is exactly where things are headed:

The inconsistencies in what’s claimed here just don’t add up. It’s either a stable balance-sheet worthy asset or a strange growing/shrinking cash pile – it can’t possibly be both.

Drag forces

Promoters of Bitcoin often mention how Bitcoin went up approximately by 100x during the last cycle before collapsing at a higher base level, and that this cycle will continue. What they forget to take into account is drag forces: it’s easier to find the first 1% who are attracted to such schemes, but harder to find the next 10%.

To assume Bitcoin will continue to grow a similar amount to that in previous cycles disingenuously assumes there’s no saturation point re: interest in Bitcoin, and people will keep paying ever higher prices. In reality, interest levels off. People won’t buy Bitcoin for $100k as casually they will for $100.

There’s an expectation by some Bitcoin proponents that the wealthy (billionaires, etc) will flock to Bitcoin and this will continue to drive up the price. But imagine you actually are a billionaire – why would you want to participate in a chaotic get-rich scheme in the first place? Instead, it’s some of the poorest, desperate and most vulnerable that are targeted to and impacted by such schemes.

Fear of Missing Out (FOMO)

There’s a reason why Bitcoin proponents often use the phrase “have fun staying poor” when challenged with logic and they have no logical answers. That phrase is not a statement aimed at the rich (who aren’t poor to begin with). Rather it’s designed to intimidate regular folks into buying Bitcoin in fear of missing out.

What’ll likely be be Bitcoin’s undoing is exactly what’s causing the current bubble – fear. Those piling in primarily for “number goes up” (the overwhelmingly majority of buyers) will just as quickly sell when “number goes down”. Bitcoin isn’t a stable store of value, it’s a macro pump and dump scheme.

Summary

Given what Bitcoin has turned into (a modified ponzi scheme), as much as I’d like to make money for investing in the right things, Bitcoin does not seem to me like a right thing. Rather it leaves one in the position of just hoping some greater fools pay an even higher price further down the line for what is otherwise quite literally a useless asset, so that one earns a profit. Isn’t that how Ponzi schemes work?

Lastly, reading this reddit post for me may have been the nail in the coffin:

I put my money into things I believe in and want to profit along side of not at the expense of. There is standard investing, and now there’s “predatory investing” where you profit by taking advantage of others. Generally I avoid the latter situation unless the “other” is someone like an entrenched hedge fund company that is itself, a predator.

Some may take an amoral stance (i.e. considering it neither good nor evil) in buying a token for $10 to sell it for $20 to someone, who hopes to then sell it on for $40, and so on, until the scheme collapses. But imagine Bob, who’s been saving a $50k deposit for his house for years, in a moment of vulnerability decides to get in on this get-rich scheme. Bob has a real job, so isn’t watching the price day and night, so doesn’t pull out in time when the price inevitably crashes, and is left with a fraction of what he put in. And given the scheme is “decentralised” he has no recourse whatsoever – his money – the fruit of years of toil and saving, all gone in a flash, with real consequences.

That’s at least 1 life very negatively impacted by an entire chain of FOMO, that one as a Bitcoin buyer contributes towards enabling. And in reality it won’t be 1 life, it’ll be thousands, potentially millions. No amount of telling oneself this stuff is decentralised can offset that.

Further notes

- Deltec bank (where USDs backing Tether are supposedly held) deputy CEO interview – checkout the YouTube comments. Note the questionable body language. He was allegedly removed from his company’s website after giving the interview, and then later put back on.

- The S2F model, which promises about $1mil per coin by mid 2025 (i.e. 25x your money in 4 years). Give there are 21 million coins, this predicts $21 trillion to be stored in Bitcoin by that time. Bitcoin proponents seem to be trying to turn this into a self-fulfilling prophecy, but to do this they have to keep shilling like crazy for it. Just do a Twitter search for Bitcoin and you’ll see what I mean. At some point I suspect they’ll become unbearable.

- I was unwittingly one of these shills for a few months, getting friends to install Coinbase so they don’t miss out on the gold rush. One of those friends stood his ground and never installed the app. It just never made sense to him and he had ethical reservations, which he told me this article helped articulate. I recently thanked him for standing his ground. He didn’t want anything to do with, in his own words, “dirty money”.

- Incredibly profitable Bitcoin miners in asia are dumping their Bitcoin at peaks in return for USD. And even then they hold tens of $billions worth of Bitcoin (supposedly soon worth $trillions). This is a huge transfer of wealth taking place at a scale that should have governments worried.

- Even Reddit’s Wall street bets, famous for the GME Short Squeeze, bans discussion of Bitcoin:

- The average transaction fee is now over $10 and rising, with actual costs for larger transactions on exchanges costing far more. Much of this fee goes into the pockets of miners, running huge farms of Bitcoin mining hardware, consuming monstrous amounts of power.

- Jacob Oracle covers the USD-T (Tether) debacle in more detail here.

- Some great discussion on the environmental and political impact of Bitcoin on Y Combinator forums.

- The class action complaint papers that detail alleged tether-related fraud.

- Ray Dalio’s analysis of Bitcoin. Note the following:

- “it is not protected against cyber risks to my satisfaction”

- “if it’s successful, the government will try to kill it and they have a lot of power to succeed.”

- A clear technical explanation of how Bitcoin is a Ponzi scheme by Jorge Stolfi.

- A comprehensive takedown of Bitcoin by Charles M:

- “No normal person is “missing” cryptocurrency in their lives. It’s pure techno babble.”

- Ryan X. Charles’ informative Youtube videos.

- Amando Abreu discusses the psychology around why many people tend to buy things like Bitcoin.

- Nassim Nicholas Taleb (who was previously an advocate of Bitcoin) has updated thoughts: